Inside the Dealerscope June 2021 issue: “Top 101 Retailers”—2020 was a challenging year for everyone, including CE retailers. Which ones came out on top? Plus, answers to the following burning questions: which YouTubers know the most about CE, how do you transform a legacy brand, and what will become of Sennheiser now that it’s part of hearing health giant Sonova?

Welcome to our Top 101 Retailers List

It’s hard to believe that we are already in June 2021; how quickly the year flies by. I am so pleased to welcome you to the Dealerscope June issue. Our big feature is our annual Top 101 Retailers list, where we reveal the lowdown on our industry’s finest according to their performance. This is always a list that is full of great information that our staff has researched and worked hard to produce. I would love to hear your thoughts after you have gone through the rankings.

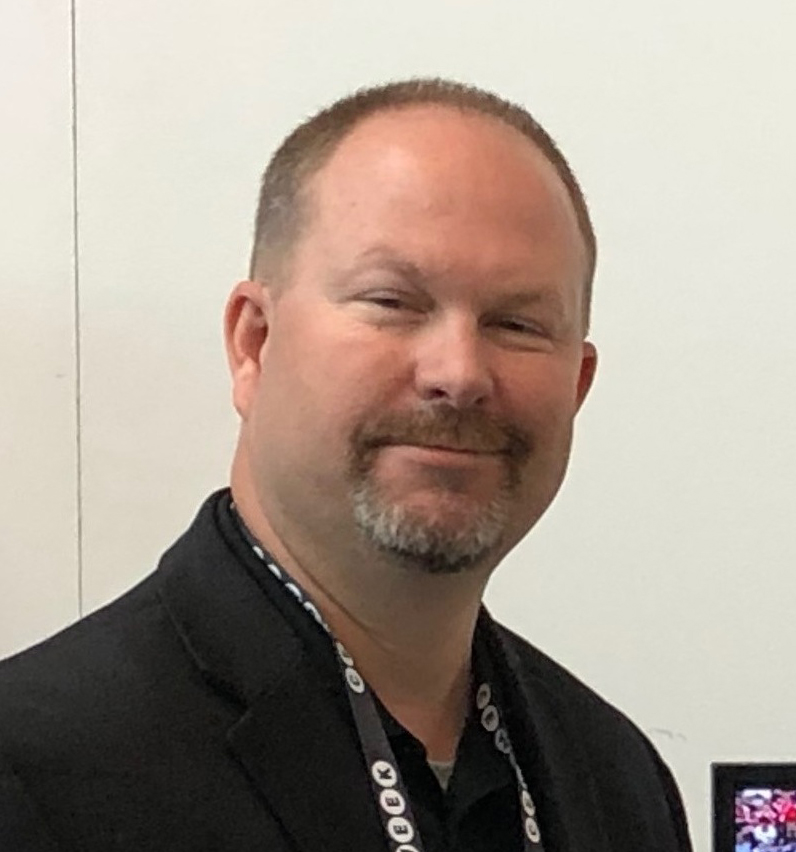

We also present in this issue our annual TV Vendor Roundtable, where Contributing Editor Nancy Klosek has gathered insights from top TV brand executives on sales trends, new technologies, as well as their market approaches for this ever-changing (and now red-hot) category through the rest of this year and heading into 2022. In-house Digital Diva Jessica Guyon covers YouTube influencers and creators in the consumer electronics space, and our Digital Health and Wellness guru, Stephanie Adamow, looks at tech in the outdoor space, as we get ready to enjoy warmer weather. Our ongoing Retail on the Run column zones in on Starpower in Dallas, as we speak with David Pidgeon and take a look at his successful company. Monthly contributor John Quain covers the changes at Sennheiser, and then, reviews the new Sennheiser IE 900 earbuds, available in June and promising to set a new benchmark in portable audio. An article by Scott Hagen, the CEO of Victrola, discusses the transformation of a legacy brand. This piece offers great lessons in business strategy, and in ways to position your company and your products.

As always, I want to thank you not only for being our audience, but most important, for your ongoing dedication and support. Make sure to follow our LinkedIn page at https://www.linkedin.com/company/dealerscope for the latest news on social media, and of course, our website www.dealerscope.com. Bookmark it, so you’ll always have instant access to all that’s happening in our industry in real time.

Lots more exciting news is coming during our transformation at CT Lab, and I cannot wait for all of you to see it.

As always, please feel free to get in touch with me at tmonteleone@ctlab.media.

Tony Monteleone, Publisher

A WORD FROM OUR EDITOR IN CHIEF

Retail’s Wild Ride: Where Is It Headed, Post-Pandemic?

With a few exceptions among the Greatest Generation, most Americans would be hard-pressed to remember a more disruptive —and transformative — year than 2020. Besides the tragic loss of more than half a million people around the globe, the once-in-a-century global pandemic wreaked havoc on almost every major industry, though the pain was not shared evenly, particularly in the retail sector. On the one hand, it’s been a retail apocalypse, magnifying trends that were already under way for many legacy stores, some of which shut their doors in 2020. (That’s why you won’t find Fry’s, Cameta Camera, or Shopko on this year’s Top 101 Retailers list on p. 34 of this month’s issue.)

Even though most CE retailers, independent or otherwise, had the advantage last year of being deemed essential during lockdown periods, those that were particularly dependent on in-store purchases faced challenges. Sales of U.S. electronics in brick-and-mortar stores dropped 21.1 percent in 2020, according to Coresight Research. Those retailers that leaned into e-commerce and omnichannel strategies were able to capitalize on a pandemic-induced, 24/7 work-and-live-at-home demand for computers, networking equipment, smart devices, cleaning and cooking appliances, and health and wellness gadgets. And they did well. From March 2020 to March 2021, there was a 23 percent rise in CE sales revenue, compared to three percent for the same period a year earlier, according to NPD (one of many fun facts about CE that analysts shared with us in 2020 on p. 18).

Meanwhile, even as Best Buy’s stateside in-store visits fell by 15 percent in its final 2020 quarter, the electronics retailer’s online sales in the U.S. rose by 144-percent in the fiscal year 2020, accounting for 43 percent of its sales last year. Best Buy is putting curbside BOPUS (buy online, pick up in-store) — my new favorite term-cum-acronym— at the center of its future strategy of converting most of its in-store product shelves and showroom spaces into warehouse storage for hyper-local fulfillment centers. More than 50 percent of U.S. retailers now offer some form of curbside pickup, up from just six percent at the beginning of 2020, according to Digital Commerce 360. Consumers have become accustomed to the convenience of ordering on their mobile phones or laptops, then sweeping in for a pickup. BOPIS is here to stay.

And yet, people have been cooped up at home for well over a year. As vaccination levels rise and COVID case counts drop, in the U.S. at least, the need to be out among other people, even other shoppers, is not to be counted out. According to foot-traffic analyst service Almanac, Target’s in-store visits rose by 17 percent in the first quarter of this year, with a five percent increase in dollar transaction per customer (see p. 50 for more “Stat Shots”). People still need help picking the right home theater system or TV, and there are still many questions about technology that anyone has, but is afraid to ask. As Starpower’s David Pidgeon confirms in our store visit on p. 29 this month, service with a smile is still nothing to be sniffed at — it might even be a winning business strategy.

Tom Samiljan

COVER STORY

The Pros And Cons

Of Pandemic-Era Retail

The unprecedented challenges posed by the coronavirus in 2020 led to success stories for retailers who leaned into e-commerce and omnichannel strategies.

Just a little more than a year ago, the outbreak of the coronavirus pandemic forced many brick-and-mortar retailers to close their physical locations. For companies that already had or were able to pivot to e-commerce and omnichannel operations, the impact was surprisingly transformative. Companies such as Amazon and Apple were able to turn 2020 into a stronger fiscal year — both companies saw CE sales in North America more than double from the previous year — than less prepared or nimble retailers. Omnichannel-savvy brick-and-mortar stores that capitalized on digital commerce options for curbside pickup also benefited, with buy online, pick-up in-store (BOPIS) sales growing by more than 563 percent in April 2020 versus April 2019, and total online sales growing by more than 193 percent in the same period, according to client data shared by e-commerce platform provider Kibo.

Big-box stores, warehouse clubs, and pharmacies, along with independent consumer electronics and major appliance dealers, were designated as “essential retail” and therefore able to keep their stores open and weather the COVID storm. GameStop, for example, argued in March 2020 that its gaming products and office supplies made it an essential retailer. Department stores with mostly soft goods such as Macy’s and J.C. Penney, which closed more than 100 stores last year due to ongoing struggles exacerbated by the pandemic, were not as fortunate and had to wait longer before they could re-open.

It wasn’t the only advantage consumer technology retailers had. As the pandemic forced people indoors for an entire year, sales in nearly every subset of CE skyrocketed. Besides playing more video games on brand-new consoles, house-bound consumers acquired more smartphones and TVs than the year prior. According to NPD technology and mobile analyst Steve Baker, CE sales revenue for the 12 months ending in March 2021 was 23 percent higher than in the same period ending in March 2020, when the pandemic kicked in. The appliances sector was no different, with the added twist of upgrades and repairs due to greater use of appliances by people who were now living and working in their homes 24/7. Countertop appliances, in particular, experienced a 30 percent increase in sales in 2020, according to NPD food and beverage industry analyst Darren Seifer.

Sadly, many previous Top 101 regulars — Fry’s, Cameta Camera, and Shopko — closed their doors for good in 2020, while other familiar names have been acquired and subsumed into other retailers’ portfolios. We’ve replaced those former Top 101 stalwarts with some exclusively e-commerce destinations, including the direct-to-consumer operations of CE manufacturers and a few famous brand names that continue to reinvent or relaunch themselves under new owners.

There are plenty of retailers that we have missed — increasingly swift technology disruptions mean that researching, compiling, analyzing, and forecasting this list is more challenging every year. Now that omnichannel is the new normal, any manufacturer or brand — even magazines and other media outlets — can easily set up and scale an e-commerce operation. Which companies belong on this list next year? It could be even more unprecedented.

Click here to contact our Group Publisher for the 101 Chart

COVER STORY

Top 101 Methodology

BY TOM SAMILJAN

TAKEAWAY TREND: Staying at home revived the TCG market, and GfK researcher Josh Wanderman reported “increased demand for investing in electronics for the home during lockdowns;” with most sales going toward work-at-home products.

Dealerscope researched technology retailers in North America — as well as hardware manufacturers selling direct to consumers — in order to devise its Top 101 registry. Information was gleaned from readily available sources, including SEC filings, corporate press releases, annual reports, business databases, analyst interviews, historical trends, and press reports.

Some companies are new to the Top 101 list this year, and some that were listed last year are no longer present. We added new methodologies this year to calculate companies’ consumer electronics (CE) sales in the United States, Canada, and Mexico, where applicable. In doing so, we found new companies worth adding, as well as several companies that no longer carry CE. Many retailers changed ownership in 2020 and are still in the process of relaunching, so we updated the information and indicated that in the Notes column, which is at the far right of each two-page chart spread.

This year we also decided, in some cases, to bundle all of the distinct North American divisions of retail brands such as Best Buy, Walmart, RadioShack, Toys R Us, and others into one entry. While those different divisions in most cases are run as separate entities with completely different ownership, they retain the same brand, so we chose to use that linking principle to give additional retailers some space on the Top 101 list.

TAKEAWAY TREND: Brick-and-mortar sales plummeted during the pandemic, and analysts at Coresight Research report sales at U.S. electronic stores dropped 21.1 percent in 2020.

Dealerscope contacted each retailer. Many confirmed or provided sales estimates. However, some privately held companies refused to disclose sales information. Other companies would not break out CE sales from their overall merchandise mixes. Finally, some companies had no comment. In these cases, Dealerscope chose to publish its best estimates. For example, Dealerscope used numbers published in the 2019 list and applied a ratio to determine the most accurate estimated increase in sales in the past year. This does not always account for pandemic-related impacts, however. In other cases, we forecast an extraordinary sales impact in 2020 over 2019 as a result of the pandemic, which we have indicated in the Notes column. Some entries have identical sales figures from 2020 and 2019; these were modeled with available public information or as identical approaches. We have footnoted those instances, where applicable.

TAKEAWAY TREND: Online shopping increased, and online retailers grew more than competitors as “consumers displayed loyalty to their retailers of choice” online instead of switching to other online-only retailers, GfK reported.

Unlike last year, all sales figures listed are based on either fiscal or calendar years, depending on what companies provided for us, or publicly available information and databases. Where possible, we listed CE sales that included electronics sales to consumers, as well as sales to corporations, governmental bodies, and the educational arena. To the best of our ability, we have excluded sales to regions other than North America, including United States, Canada, and Mexico. CE estimates include sales of pre-recorded media. For any other explanations behind our methodology and the asterisk footnotes or results, please refer to the Notes column. And don’t forget to check out additional insights on the top 2020 CE retailers elsewhere in the issue.

All sales and store count information should be considered Dealerscope estimates.

CE RETAIL TECHNOLOGY

June 2021 CE News

Retailers Begin Dropping Mask Requirements

Target, Walmart, Costco, and other retailers have been easing mask requirements inside their stores for fully vaccinated customers and employees. The store policy changes align with the CDC’s recent guidelines stating that fully vaccinated Americans can resume regular activities without wearing a mask or physically distancing. Many retailers are strongly encouraging unvaccinated shoppers, who remain at a much higher risk of contracting the coronavirus, to continue wearing masks during visits.

Chip Shortages Have Entered a New ‘Danger Zone’

Research conducted by the Susquehanna Financial Group showed that wait times for chips increased to 17 weeks in April, representing the longest wait time since the firm began tracking this data in 2017. Buyers have made the problem worse by hoarding semiconductors in an attempt to stay ahead of their supplies – a dangerous pattern we’ve already seen throughout the pandemic with toilet paper, cleaning supplies, and gasoline.

JCPenney Continues Job Cuts

JCPenney’s latest “restructuring effort” meant job losses for 650 employees across its store, field, and corporate teams. When the retailer filed for bankruptcy in May 2020, it still had 846 stores in operation with about 84,000 employees. One year later, JCPenney has been forced to close more than 150 stores and let go of about 34,000 associates. According to new management, the company is now “leaner” and better positioned to meet new priorities.

Walmart Experiences Strong Q1 Growth on the Back of Online Sales

Walmart saw continued sales growth during its spring quarter amid stimulus spending and easing COVID restrictions. Total revenue increased 2.7 percent in Q1 and U.S. sales grew five percent. E-commerce sales in the U.S. were up 37 percent, representing over 12 percent of the company’s total sales. CEO Doug McMillon says he is “anticipating continued pent-up demand throughout 2021.”ay Store foster anticompetitive behavior. Google has also agreed to testify at the hearing.

Southern California Warehouses Face New Pollution Rules

In an effort to combat pollution affecting many minority communities, Southern California air quality regulators have imposed new rules impacting 3,000 warehouses across the region. The “warehouse rule” requires distribution centers to implement changes to their workforces that will help offset emissions. Options include installing solar panels, switching to electronic methods of transportation, and donating air filters to neighboring schools and daycare centers.

INTERNATIONAL PERSPECTIVES

Our Analysts Told Us

We asked industry experts at NPD, GfK, and Coresight Research for insights on pandemic-era consumer technology usage and behavior. Here are their top takeaways.

BY SAMSON AMORE

As part of our research for the Top 101 Retailers of 2020 list (see p. 34), we spoke with retail, consumer technology, and gaming analysts to get their take on the most surprising consumer tech usage and buying trends, both in the U.S. and across the globe. Store closings, pauses in manufacturing, and chip shortages aside, nearly nine months of people living and working at home was, on the whole, good for the consumer technology business. Here are some of the more notable expert insights we gathered.

Gaming exploded.

People played more video games and bought more game consoles; the popularity of virtual life management game Animal Crossing caused a run on, and subsequent shortage of Nintendo Switch units last year, for example. In the U.S. alone, consumers spent $56.9 billion on gaming throughout 2020, a 27 percent increase from 2019, NPD Group games industry analyst Mat Piscatella says. From gaming hardware to software to accessories and merchandise, every aspect saw sales increases last year.

Newzoo similarly found that video game console sales increased five percent in 2020. Analysts at the games and esports data company expect that 2021 likely won’t surpass 2020’s record sales, and told Dealerscope they anticipate a “corrective year,” with sales registering a “slight decline.” Overall, the games market remains entirely strong and Newzoo forecasts it will generate $204.6 billion in revenue by 2023. By the end of 2021, there will be an estimated 2.9 billion gamers of all ages playing games across the globe, Newzoo predicts.

People spent more time on their phones.

According to John Harmon, senior analyst at retail and tech advisory firm Coresight Research, smartphone sales grew slightly in 2020. Data from Coresight and the Consumer Technology Association (CTA) show that U.S. smartphone sales were up $79 billion, a roughly two percent increase from 2019.

The share of people playing games on their phones is also growing. Mobile gaming is expected to grow roughly 4.4 percent to revenue of $90.7 billion worldwide in 2021, according to Newzoo. By contrast, in Europe, where “city weekends” are popular due to shorter distances and robust train infrastructure, and where lockdowns were enforced more strictly, telecom purchases were down by 3.7 percent due to less interest in outdoor and travel devices.

The biggest surprises were good news.

Appliance sales grew significantly in 2020, “following the trend of workers at home improving their work and leisure setups,” says Harmon, and he added that such domestic upgrades were also the reason that TV sales were “actually much stronger than expected.” TV sales grew 0.8 percent, a surprising outcome considering that the CTA had forecast a 14 percent decline for 2020.

“The long-term strength of sales has been one of the biggest surprises,” says NPD Group technology and mobile analyst Steve Baker. “Volumes were built quickly in 2020 and then have stayed at those levels through all the shifts and changes of the overall societal environment.” He says the most positive impact the pandemic had on the CE space was that consumers were reminded of the value that consumer electronics devices bring to their lives, along with new ways to deploy them at home. “Whether it was the rediscovery of Wi-Fi in their homes (and the consequent growth of mesh networking products), the realization that a multi-monitor environment in their home office is just as useful, and easy to create, at home, or the reigniting of their love affair with big-screen TV, the value of home electronics only increased.”

Across the pond, GfK analysts said one surprising trend in Spain, France, Germany, Italy, and the U.K. was the “accelerated demand growth for online, and click and mortar” purchases, which is what is increasingly referred to in North America as BOPUS (buy online, pick up in-store). In those “Euro 5” countries, as they are collectively referred to, said click-and-mortar purchases jumped 168 percent, online-only rose 64 percent, and purely in-store purchases declined by 33 percent in 2020.

The consumer love affair with technology lives on.

Piscatella believes that gaming sales will continue to increase. “It is safe to say the demand will outpace supply on both console and PC gaming hardware into 2022,” he says. “2021 will be a year where supply will be more impactful to the video game market than demand.”

While the pandemic did accelerate demand for new products, it also forced some retailers to rapidly scale and face the challenges of procuring new supply chains during a time when many people were out of work. Per Baker: “The biggest negative for the industry is the disruption caused by the rapid change in channels and transaction behavior, along with the need to build new models to support retail partners and consumers with these new purchase motions.”

INTERNATIONAL PERSPECTIVES

The Five-Year Span

Which top retailers experienced the most growth in CE sales since 2016? We dove into our 2020 Top 101 Retailers list to find out.

BY SAMSON AMORE

Besides seeking expert opinions, we also looked at a few trends generated by our own Top 101 CE Retailers list (p. 34). Looking at data over the past five years of lists, we focused on the consumer electronics sales gains from 2016 to 2020 of the top five retailers by 2020 CE sales.

At No. 3 on this year’s Top 101, Apple has seen an estimated 128.1-percent rise in consumer electronics sales since 2016. Even with an overall decline in iPhone sales over the past five years, the company continues to break records.

According to Wedbush Securities and USA Today, the iPhone was the top-selling consumer electronics device in 2020, with 195 million units purchased (though not all at stateside Apple stores). Even though more iPhones, at least in the U.S. and Canada, are purchased directly from wireless carriers and stores like Best Buy, the sheer number of sold units, not to mention all the Macs, Apple TVs, and iPads, is significant to move the Apple Store sales needle.

Warehouse club Costco, which was No. 7 on this year’s Top 101 list, experienced a jump in CE sales of 118.3 percent, due in part to the increasingly affordable pricing of big-screen TVs and laptops over the past half-decade, and also more recently to increased demand for TVs, appliances, computers, and other devices needed for a homebound 24/7 lifestyle.

And, no surprise — Amazon, which took the Number One spot on the 2020 Top 101 list, has seen growth of CE sales rise 140.23 percent over the past five years. More recently, we calculated a nearly 40 percent rise in CE sales between 2019 and 2020.

That’s impressive, but not quite as impressive-sounding as last year’s 200-percent rise in overall revenue, which encompasses such non-CE sectors such as the company’s music, streaming, and content production divisions, Amazon Web Services (AWS), Twitch, Diapers.com, Zappos, and Whole Foods. Oh, and something called “books.” —SA

Video

Record Changer

The lessons I learned from transforming a legacy company.

By Victrola CEO Scott Hagen, pictured left at the audio company’s new Denver headquarters.

Victrola’s new midcentury-inspired “Eastwood” turntable.

I joined Victrola as CEO in October 2019. As a lifelong music lover, the brand is at the center of some of my earliest and most vivid music memories. I can still see and hold the blue Victrola suitcase turntable gifted to me when I was a child. On it, I wore out the Beatles 45rpm record of “Hey Jude” with “Revolution” on the flip side.

But I knew nostalgia alone shouldn’t drive my decision to lead a company. I did a lot of research to answer two key questions: “Is there a clear path forward for the 100-plus-year-old brand?” and, “Can I positively influence that path forward?”

The answer to both questions was yes. Since then, my team and I have embarked on a massive transformation to re-center Victrola as a music-first, memory-building brand, delivering quality products to fans in collaboration with partners.

We are nowhere near done, but we have learned some things about evolving a legacy company along the way.

Without a ‘why,’ there is no anchor.

When I arrived, the company had passionate employees but no mission statement. It was clear that Victrola was a music brand, but what we didn’t have defined was our underlying promise to consumers.

Some may think mission statements are superficial. I think they should capture a brand’s reason for being. Our approach was to build our mission up in a way that grounds company strategy and serves as a lighthouse for future product development, internal and external communications, partnerships, and more.

After much research and discussion, we agreed on a mission statement: We create lifelong music memories for everyone. Almost every word in it is meaningful.

Lifelong stands for quality, trust, and timelessness. As a brand, Victrola first emerged as a product of the Victor Talking Machine Company, which was founded in Camden, N.J. in 1901. Its iconic original logo — a dog sticking its snout into the horn of a phonograph — remains synonymous with the idea of the record player. Lifelong is about living in people’s homes across generations — I first experienced records on a many-decades-old crank-up Victrola at my grandmother’s house. The technology and design may have originated more than a century ago, but except for the horn speaker, record players pretty much work the same way.

As for music, it’s our craft and our passion. If a Victrola product is not delivering music, we’re not creating it. Similarly, if you’re working at Victrola, you’re a music lover (or a failed musician, like me).

The word memories ensures our products help consumers create special moments on which they can reflect — the first time they play their favorite album for their son or daughter, for example. And everyone is about accessibility. There are music lovers of all shapes and sizes out there, and we want to be their brand of choice.

The mission statement became our why, and we make every decision with it in mind.

Vintage wind-up Victrola Talking Machine from the 1920s.

Consult with customers and partners.

To get to our why, we looked internally. Looking externally was also critical to arriving at the truth.Here’s what we learned from our customers. Awareness levels for Victrola were 56 percent higher than our closest competitor, but a significant number of people thought the brand was obsolete. Those who did buy were not fully satisfied with the overall experience. A common thread was: “It doesn’t quite sound as good as it looks.” Still, those consumers were attached to the brand and looking for more opportunities to engage. Customers also told us they were willing to spend more for better sound quality, but they wanted simplicity. This led us to immediately addressing our current assortment, improving the acoustics, electronics, and materials.

For our factories and reseller partners, we took a consultative approach. Our goal was to understand what was working, and what we could do better. We learned there were too many products in our line and not enough focus on quality and differentiation. Because of that, it was hard for partners to understand what Victrola stood for, the clear benefits for end consumers, and what products to put on shelves. Some of our partners had gaps in their assortment that, if filled, could increase their profitability.

At the same time, we understood more people were listening to records than we ever imagined, and music continued to be a lifelong passion point. We did a survey and asked people if they had a vinyl record player in the home. Sixty percent said yes. Of those, more than 60 percent said they used it more than once a month, and nearly half of them stated they were interested in purchasing another record player.

The potential was undeniable. And, starting a new online record store, which we launched at the end of 2020, became an obvious strategy.

Our store is an important tool for us. It teaches us about customer preference, builds lifelong relationships, and helps drive a complete solution for consumers. The added online retail experience means that today, customers come to our website to browse, purchase, and tell us what they think more regularly. We’ll be listening (and also, ready to sell them a new record player).

Don’t skimp on product development.

It seems counterintuitive, but the first thing we did to elevate product development was to dramatically decrease the number of products we created.

We went from about 340 active SKUs per year to 50. This move eliminated distractions in our product offerings — retro refrigerators, lava lamps with speakers — that didn’t align completely with our mission. It allowed us to refocus on music products that not only look and sound great, but are also easy to use.

We also invested in engineering, acoustics, and design talent — people equipped to build products with soul.

But it wasn’t a straight path. We had to zig and zag a bit to meet market demand. When our new Head of Product and Brand, Don Inmon, joined in January 2020, his Number One charge focused on our holiday products. Don squeezed a product development process that typically spans a year and a half into just three months. I wouldn’t necessarily recommend such an accelerated overhaul, but we were fortunate to have the immense talent of Don and his team to create some solid interim products with improved audio quality.

Moving forward, we will afford product development the space it deserves and approach it from a position of quality and building trust.

Build operations around the strategic plan.

For many years, Victrola operated like a successful entrepreneurial, founder-led organization. However, few processes existed to allow for sustainable practices or an ongoing global business rhythm. This wasn’t a big deal…until it came time to scale. When a company moves to meet the masses, the need for structure becomes imperative.

We had so much to tackle on the product side that we pushed off truly operationalizing our business rhythms, structures, and practices until recently.

In hindsight, I’d build an operating rhythm around the strategic plan out of the gate instead of forcing a strategic plan into current and limited processes. Processes ensure you achieve the critical outcomes to complete a strategic plan; they are not meant to make life easier for one person or group. The moment a process gets in the way of serving the grand mission, it’s wrong. It needs to be fixed or even blown up.

So, where are we on our transformation mission? I’d say about three-fourths there.

We are months away from completing our operational transformation, and from a product and customer perspective, we are well down the path of delivering the future of Victrola. For example, we added a new product development team that in less than one year filled the gaps our customers told us exist in the record player category. This includes an all-in-one system that looks beautiful, is easy to use, and sounds like a premium audio system, as well as a more portable suitcase turntable. The products will be in the market starting late summer.

Next, we want to explore how technology and vinyl complement each other. Playing records over Bluetooth resulted in a customer wow factor. You will see us continue to use our understanding of acoustics and technology to improve sound even more on our players.

I get jazzed when we see signs of positive evangelism. Partners are responding to the differentiated line by carrying more of our products in-store. We are increasing our share-of-shelf.

We started addressing consumers more proactively via different media channels and achieved one billion impressions in under 60 days as a result of a strategic campaign and our PR agency’s partnership. Consumers are also finding the connection they sought. One customer told us: “I can’t believe how great it is to listen to my old records again. It feels like home.” Moments like these, when you see the mission come to life, cause a collective employee rush.

If I’m honest, I’d probably say we are always three-fourths there. The funny thing about potential is the more of it you achieve, the more it expands. Some may consider that a tease, but I see it as an opportunity to become even better, every day.

UNBOXED

The Last Hurrah?

With its new IE 900 earbuds, Sennheiser, as an independent consumer audio company, goes out on a high note.

BY JOHN R. QUAIN

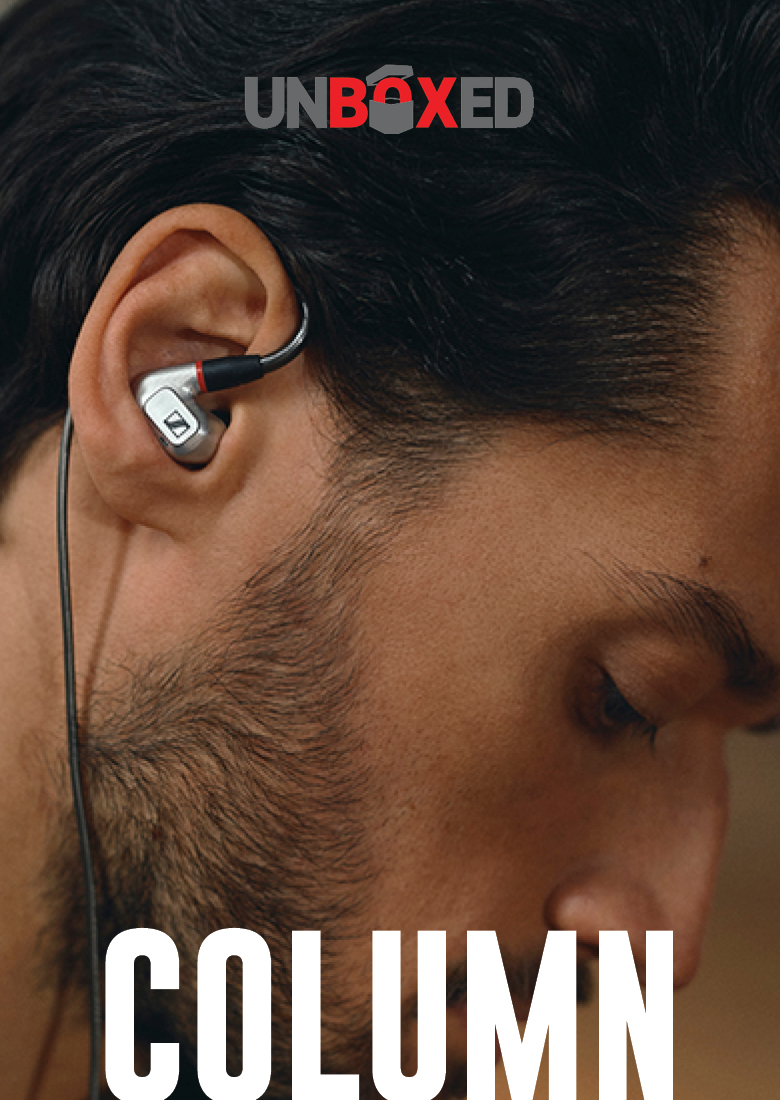

Coming out in June, the new Sennheiser IE 900 earbuds may have wires, but that helps them be among the best earbuds we’ve ever tried.

Presented in a padded black box and glinting like a pair of diamond earrings, Sennheiser’s new IE 900 wired earbuds set expectations high — very high. As days of auditioning proved, they manage to deliver on the promise, and then some.

Touted as earphones for audiophiles, the IE 900 earbuds are priced accordingly at just under $1,300. The wired in-ear speakers eliminate the compression and dropout issues of wireless earbuds and convey uninterrupted high-resolution sound without any noticeable depreciation of dynamic range. A solid aluminum housing is milled to accommodate Sennheiser’s 7mm X3R transducer, which contains three resonator chambers.

The most pronounced difference between the IE 900 and previous generations of audiophile earphones is that these ’buds possess clarity and precision in reproducing sound, particularly in the high end, but never sound harsh. With a beyond-human-hearing-rated frequency response of 5 to 48,000 Hz (-10 dB), the IE 900 earbuds would seemingly produce high notes with excessive sibilance and listener fatigue. On the contrary: String instruments are taut without ever becoming unnaturally sharp, while vocals have a limpidness that can make you feel as though you’re sitting next to the singer. Simultaneously, bass notes are appropriately resonant without losing any definition.

For improved comfort, the IE 900’s detachable cords have malleable stretches near the connectors to act as ear hooks and take some of the weight off of the ear inserts (foam and silicone pieces are included). While over-the-ear cans may still be preferable for many listeners, the in-ear IE 900 earbuds can be worn for hours without discomfort.

Compared to ported models and other past attempts to make in-ear models faithfully reproduce music, the IE 900 earbuds are the best that Sennheiser has produced so far. We just hope that with the sale of the consumer electronics division to Sonova, this isn’t Sennheiser’s last hurrah.

AUDIO

The Sound of a Sennheiser Sale

A legendary audio family brand sells its iconic headphone division to a Swiss hearing aid firm.

BY JOHN R. QUAIN

Dr. Andreas Sennheiser (left) and Daniel Sennheiser are not only brothers, but also co-CEOs of the eponymous family audio business.

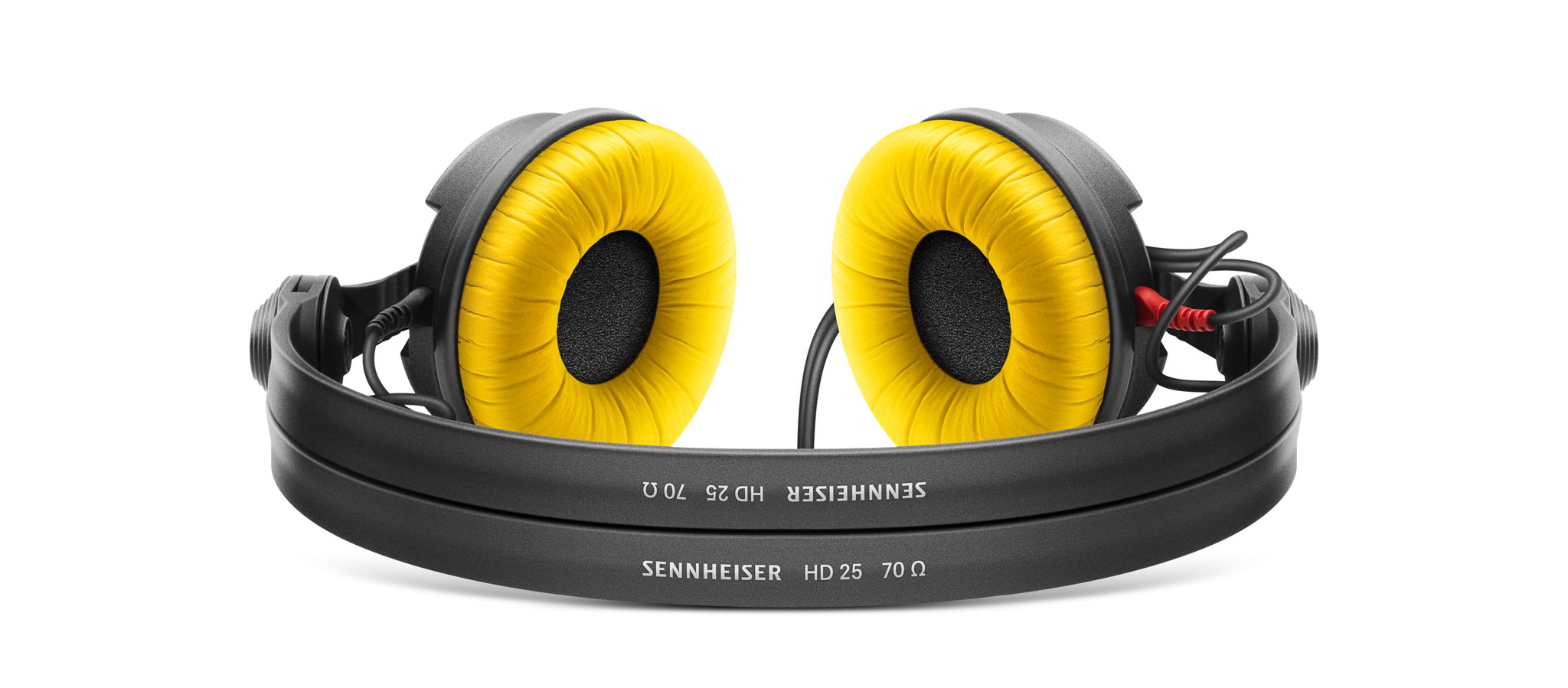

To music aficionados and audiophiles of a certain age, Sennheiser’s original open-air headphones with their yellow earpads evoke an emotional response comparable to the redolent odor of a new vinyl record or the sensual curve of an SME tonearm. So it’s understandable that the sale of the German audio manufacturer’s consumer electronics division to a large public company came as something of a shock when it was announced in early May.

True, the Sennheiser brothers, co-CEOs Daniel and Andreas, have been open for months about their intention to sell the family’s consumer audio business in order to focus on the professional products division, which makes studio monitoring headphones and microphones. But the reality of the change finally arrived with the announcement that Sonova Holding AG, the Swiss-based global hearing aid company, would acquire the consumer electronics part of Sennheiser, which includes its headphone and soundbar products.

“The market has changed, even for the audiophile niche,” said Daniel Sennheiser in a video call with Dealerscope. “The market has become extremely dynamic, with products such as true wireless.”

“And there are new technologies to improve the man–machine interface, like voice commands and curated hearing,” added Andreas Sennheiser. “Is it being used in a noisy environment? In some places, you want the amplification of voices.” The brothers said they recognized that the consumer side needed to grow, but that only a larger company with deep pockets and complementary technology would be capable of the task.

“There’s definitely technology we can share,” said Arnd Kaldowski, the CEO of Sonova, on the same video call. Kaldowski pointed to Sonova’s expertise in miniaturization and its high-end hearing aid business, which includes such brands as Phonak, Unitron, and Advanced Bionics.

For Sonova, Sennheiser’s audio fidelity skills represent access to a new demographic. “In the hearing aid market, the average age of a customer is 71 years old,” noted Kaldowski. By adopting sound reproduction technology from Sennheiser, Sonova could reach a younger generation before hearing loss becomes an issue.

“There are people out there with hearing difficulties for whom a traditional hearing aid may not be an option,” points out Ben Arnold, NPD’s consumer technology industry analyst, whereas true wireless earbuds are the kinds of products people are accustomed to wearing and therefore could fill a unique need. Both partners see particular potential in the market for speech-enhanced hearables and for true wireless and audiophile headphones. A recent Arizton Advisory report predicts that the earbud and headphone market alone will grow at an annual rate of 11 percent from now through 2026. How much new investment Sonova is bringing to the headphone business in order to participate in that growth isn’t clear, however. Financial terms of the sale have not been released, but the effect on audiophile sensibilities is clear.

Popular with DJs for the past 25 years, the Sennheiser HD 25 headphone was released in this limited edition model last year.

Perhaps the most storied brand in headphones, Sennheiser was founded in 1945 near Hanover, Germany by Fritz Sennheiser, Daniel and Andreas’ grandfather. In its early days, the company began with microphones, but it wasn’t until 1968 that Sennheiser came of age by introducing the first open-air headphone, the HD 414. The five-ounce open-backed headphone was a revelation in a market dominated by heavyweights such as the Koss Pro 4AA, which tipped the scales at a hair-pulling 19 ounces.

The Sennheiser 414 also delivered a different kind of sound, with a wider soundstage that gave recordings more of a live feel. It was a sound that the public liked. With an estimated 10 million pairs sold worldwide, the HD 414 became the best-selling headphone of all time. Today, even though Sennheiser no longer produces the HD 414, the company still sells replacement earpads for owners.

In the 1970s, Sennheiser strengthened its sonic reputation by introducing the HD 424 open-air headphone. With larger and more accurate drivers, the HD 424 delivered a more balanced bass response and a warm, natural sound that fans of vintage audio equipment still claim surpasses much of what’s available today. For audiophiles snapping up high-fidelity stereo equipment at the time, the breathlessly accurate HD 424 was nothing less than a trip to the moon on gossamer wings.

There is no question the headphone business has gone through considerable upheaval since then, particularly with the 2008 introduction of Beats of a bass-heavy sound profile. Since then, just about every audio brand has jumped into the $300 headphone market. And now more users are discovering the freedom of true wireless earbuds with the likes of Apple’s AirPods.

“True wireless has become the central focus of the stereo headphone market,” said Arnold. “Sales in the segment are up 20 percent in the 12 months ending March 2021.” Arnold notes that while consumers are moving to lower-cost products, they still care about high-end features and sound quality.

“We understand there are different segments,” emphasized Kaldowski. “We have no interest to dilute to the lower end of the market.” Kaldowski pointed out that Sonova has focused on the high end of the hearing aid business and is looking at new technologies to improve streaming audio for audiophiles, too, and help them with ways to avoid hearing loss. “Active speech enhancement functionality is next,” he said.

As for the Sennheiser brothers, they plan to build on the professional audio business. Along with open-air headphones, the ’70s were also a time when Sennheiser cemented its sonic reputation with its microphone business, catering to the likes of Led Zeppelin, the Rolling Stones, and Johnny Cash. Today, the company also owns another legendary microphone brand, Neumann. The Sennheiser brothers told Dealerscope that they planned to focus on this part of the business as well its aviation products.

As for Sennheiser’s existing research facilities in Wennebostel, Wedemark, near Hanover, Kaldowski said Sonova has no plans to move the department at this point in time. While the hearing aid firm is headquartered in Stäfa, Switzerland, just outside of Zurich, Sonova has divisions around the world that can take advantage of expertise in particular areas, of which Sennheiser’s respected audio research will remain an integral part. Currently, there are about 600 employees in the consumer electronics division of Sennheiser.

Daniel and Andreas insist the Sennheiser brand will persist and prevail. Sonova has made licensing arrangements for the future use of the brand. While details about the direction of future audio research have yet to be hammered out, Andreas Sennheiser says that impressive new models will continue to appear in the near term. Indeed, the company just announced the debut of a new set of audiophile-grade wired earbuds, the IE 900, which will appear in June for $1,300 (see sidebar).

“And not to worry, your HD 650 will continue to exist,” said Andreas, referring to one of Sennheiser’s most well-regarded over-the-ear headphone models. “The entire market should rest assured that we will maintain our entire audio competency.”

Daniel Sennheiser concurred: “We’ve been good at understanding what the audiophile needs, and that’s not going to change,” he said. “There will always be audiophiles.”

With 10 million pairs sold worldwide, the HD 414 became the best-selling headphone of all time.

Summary

Joerg Sennheiser, left, and company founder Fritz Sennheiser in 1982.

- Founded in 1945, the legendary German audio company will sell its consumer electronics division, which makes headphones, to Swiss hearing aid conglomerate Sonova.

- The sale will help the Sennheiser brand take advantage of the burgeoning headphone and earbud market, which is growing at an annual rate of 11 percent through 2026.

- With new access to a younger demographic accustomed to earbuds, Sonova will expand beyond its high-end hearing aid focus to develop technologies that help music lovers prevent hearing loss.

Four Tech Youtubers To Follow

How to stay on top of the latest consumer electronics news and reviews? Join the millions who subscribe to the channels of these top creators.

Just a decade ago, the term “social media influencer” was practically unheard of. Now, many of these internet sensations can be credited with driving billions of sales to companies across almost every category imaginable — including consumer tech.

As a brand, staying in the loop on what influencers are talking about is important because their viewership may look a lot like your target audience. As a retailer, these YouTube creators will help you stay on top of new products, how they work, and which ones will be in demand.

Let’s take a closer look at a few YouTube creators in the consumer electronics space. Subscribe to these channels, and you’ll be sure to stay in the loop.

MrMobile

1.12M Subscribers

As his username suggests, Michael Fisher’s main beat is mobile phone reviews, though viewers also get a taste of other gadgets such as laptops, smartwatches, and headphones. The affable Fisher doesn’t shy away from any brand or style of phone — he’s reviewed everything from iPhones and Androids to touchscreens and foldables. And not everything is new: Some of his best-performing videos take viewers back in time to the era of flip phones and QWERTY keyboards. While Samsung and Apple still dominate the market on a global scale, MrMobile’s videos prove that there is a lot of nostalgia tied to mobile phones that may be worth tapping into.

Marques Brownlee

14.1M Subscribers

You’d be hard-pressed to find a Marques Brownlee video that hasn’t surpassed several million views already. The 27-year-old has been creating videos since he was in high school and has made quite a name for himself in that 13-year-span. Brownlee is not just another online gadget reviewer; his channel started with hardware tutorials and freeware videos, and later blossomed into product reviews and interviews with high-level executives and politicians. Some of his past interviewees include Barack Obama, Mark Zuckerberg, and Bill Gates. He even made an appearance in the 2016 Democratic presidential primary debates, where he wasn’t afraid to ask hard questions about privacy and national security as they relate to tech companies.

TechMe0ut

346K Subscribers

TechMe0ut got her start on YouTube after recognizing a major gap in technology tutorials on the platform. Though tech-savvy herself, she noticed many of the videos she was coming across were geared toward those with a higher skill set. She set out to create more content for beginners who wanted to learn more about all the features on their iPhones and Androids. These smartphone “tips and tricks” have become a cornerstone of her channel, which also features reviews, gift guides, giveaways, and more.

iJustine

6.87M Subscribers

Justine Ezarik has one of the most varied tech channels on YouTube, with everything from product reviews to video game streams to what she refers to as “failed cooking attempts.” In addition to poking fun at herself, Ezarik also cracks jokes about politics and the controversy around 5G. Product reviews and blogs make up the bulk of her content, but she’s also been spotted behind the wheel of a few luxury vehicles, and test drives electric bikes and drones. Ezarik was also a digital anchor at CES 2021, where she captured her experience in a behind-the-scenes vlog for her subscribers. Ezarik’s videos are as informative as they are humorous.

More Influencers to Watch:

Unbox Therapy

Former Apple repair store owner Lewis Hilsenteger is an avid reviewer of unusual tech, such as the $4 smartphone and wallpaper TVs, but also answers burning questions such as whether or not you can drill through an Airtag.

Krystal Lora

Few gadgets are out of Lora’s budget, as evidenced by her playlist dedicated to shopping hauls where she “wastes” upwards of $1,000 at Best Buy, Walmart, and Target.

Danny Winget

This self-described family man often uses his wife and children as the subjects of his photos when testing smartphone cameras, but also makes videos on “anything that inspires him,” including computers, smarthomes, and cinematography.

Tech With Brett

Mobile and smart technology expert Brett Bristow creates step-by-step tutorials on setting up everything from voice assistants and mesh networks to iPhones and Chromecast, using his own connected home as an MTV Cribs-style backdrop.–JG

TV VENDOR ROUNDTABLE

Inside the TV Sales Boom

Executives from major vendors paint a ‘big picture’ of a red-hot consumer market fueled by the pandemic — and the momentum is likely to carry into 2022.

COMPILED BY NANCY KLOSEK

Large-screen TV sales set records in the pandemic year of 2020, and CTA offered estimates

released during early Q1 of 2021 that demand – while it would somewhat abate – would likely remain high for the year, registering the second-highest shipments volume on record. Are your numbers tracking along a similar curve with overall industrywide TV sales? And are price-points holding up – particularly in the strong growth area of ultra-large-screen sets?

David Gold | President, Hisense USA:

Hisense achieved a significant milestone last year in having the largest increase in LCD TV market share in North America. We saw tremendous growth, especially in the larger TV size category.

James Fishler | Senior Vice President, Home Entertainment Div., Samsung Electronics America:

While industry sales of 75-inch-plus TV sets are up around 20 percent, sales of the same larger screen sizes for Samsung have been significantly higher at 43 percent year to date. Price points are holding up across sizes, but especially in the larger screen sizes, where our ASP in 75-inch-plus is $1,544 (versus $1,522 last year).

Scott Ramirez | Senior Vice President,

Sales & Marketing, KONKA North America:

Demand remains very high, across screen sizes. However, our actual sales growth has been constrained by industry supply chain issues, including panel availability and costs, chip issues and shipping costs. KONKA is in the process of analyzing multiple MP (mass production) locations, looking at cost of labor, cost of shipping, local supply chain availability, and more. We are also in discussions with multiple panel vendors to better forecast the quarters ahead. There are some industry share shifts happening that are supply-based. Moving forward, some of these changes may become new trends, while others will revert as the supply stabilizes.

TV retail price points are increasing, possibly for the first time in history. The increases are mostly concentrated in the volume zone where margins were already stressed. The biggest takeaway from this is that consumers are willing to pay a little more for quality, value and timely purchase gratification. As an industry, I don’t believe that we need to continue matching every quality and feature improvement with a corresponding price decrease.

Chris Hamdorf |

Senior Vice President of Sales, LG Electronics:

XL TV sales are very strong for LG with our OLED77CX TV as the industry’s best selling ultra-premium TV. Consumers who are demanding an XL screen size with unparalleled picture quality are buying LG 77-inch OLED TVs, and we are also about to launch our largest 4K OLED, with an 83-inch addition to our C series. We are looking at extremely strong demand for that screen size as consumers look to replicate a true theater experience in their homes. Our 75-inch-to-86-inch LED TVs are also among the best-selling XL TVs in the industry.

John Homlish |

Senior Vice President, Skyworth USA Corp.:

Skyworth is experiencing high demand for 65-inch-and-larger-screen size TVs. Our top sellers are our 65-inch screen size, and we are also seeing higher demand for the 70-inch-and-above sizes. Our price points are holding up.

Daisuke Kawaguchi |

Vice President, Home Entertainment & Sound,

Sony Electronics:

As you noted, the large-screen-size segments grew more in 2020 than previous years, and Sony has observed this same trend in our sales. Demand increased last year due to the increased time spent staying at home during COVID-19. Shifts in consumer behavior and content consumption this past year have driven strong growth, especially during the holiday season, when the premium segment of $1,000-plus TVs had outpaced total market growth by more than double.

The large-screen-size segment — $1,500-plus — grew even more than other segments, because people have invested in their home environments more due to stay-at-home orders. We expect this trend to last for the next few years.

Chris Larson |

Senior Vice President, North America, TCL:

We are seeing extremely strong consumer demand for large-screen televisions. Recently, the consumer seems to be seeking better product instead of entry-level in these massive sets. They have discovered what the home entertainment experience can be like with the growth of streaming services and new studio distribution strategy, taking advantage of immersive jumbo screens, QLED, Dolby Vision, etc. The ability to watch whatever you choose whenever you choose it creates the perfect family consumption experience. By embracing the top two streaming platforms with Roku and Google, TCL is confident that the user is finding the content that they want.

TCL is currently launching our “XL collection” to help solve for this demand. A selection of 85-inch screens — with larger sets coming later in the year — with various levels of performance help drive that immersive experience from a theater to a home. The fact that so many first-run movies are being released straight to streaming-only services makes this solution even more attractive. I mean, would you rather drive to the mall, hassle with parking, and buy expensive tickets or concessions to attend a crowded sticky theater — or just head to your family room and enjoy the movie with your family in the comfort of your own home?

Brett Hunt |

Senior Vice President, Sales & Marketing,

Westinghouse Electronics:

Our brand is tracking along this curve, and we have grown our share year over year, due to the demand for Smart TV and our full line of Roku TVs. Our expectation is that the “stay-at-home economy” we have experienced should continue to impact demand, but the consumer will face a reset of higher retails to accommodate the higher core component costs manufacturers are faced with.

Name one or two feature or technology points about your company’s top TV offerings this year that stand out to consumers right now. What feature sets are most appealing in 2021 to TV purchasers who may just be beginning to emerge from a pandemic mindset?

Ramirez: People don’t really want features, they want benefits. In general, consumers want the benefits of great picture quality and simple, yet robust, connectivity. For the industry, features are simply the technology proof points for these coveted benefits. The KONKA lineup offers a great example of what consumers are looking for, as we target the best possible mix of quality, technology and value, in the volume zone. If we drill down to a few key features, a wide color gamut, with 100 percent-plus of DCI-P3, has become a true quality step that people now understand; that’s why it has become the first real step in most lineups. Whether that is achieved by QLED, OLED, or other technology, it’s the rich picture that people now want. A second key feature is high contrast. Again here, there are multiple technologies being used to achieve this, including OLED, Mini-LED, Local Dimming, HDR and more. However, it’s the dimensional picture depth and overall realism that are truly compelling. A third key feature is a smart platform that provides the top A/V apps, without creating setup or usage pain points, and includes simple and effective voice control. These days, simplicity and convenience are paramount with consumers.

Larson: TCL always develops our sets by first understanding the needs and desires of our users. TCL’s innovation in mini-LED has certainly started a trend in high-performance televisions, as evidenced by competitors who are now following our lead. When you combine this new and exciting backlight technology with quantum dots and HDR technologies like Dolby Vision, we are certainly delivering the color, contrast, and clarity that users aspire to. However, we must be careful to provide solutions for all our users. Some just want the convenience of a delightful and accessible smart experience like we deliver in our 3- and 4-series product. Our goal remains steadfast: to deliver joy and simplicity to our users’ lives via the thoughtful execution of technology. That exact recipe may change from series to series, but it remains our objective across our entire lineup.

Fishler: Picture quality is always important to consumers, and our new NeoQLED lineup offers the premium viewing experiences consumers have come to expect across 4K and 8K lineups. During the pandemic, features that helped simplify the everyday lives of our customers, such as Samsung Health, our TV Plus Streaming platform, and the design-forward features of our Lifestyle TVs grew significantly in adoption and engagement, really expanding the role of TVs in their homes. In 2021, we’ve expanded on those features and enhanced performance in areas such as gaming, making the TV a more integral part of everyday life.

Hunt: Roku TV has been key for us. Consumers want easy access to their content; they want to have access to all content, and Roku has always been one of the first to adopt new streaming content providers. Also, consumers are very familiar with the Roku brand and trust in what they deliver.

Gold: We’re excited to bring our breakthrough Dual Cell technology into living rooms this year. With over two million dimming zones and an impressive dynamic contrast ratio of 2,000,000:1, our U9DG TV is one of the most advanced LED TV technologies in the industry. We also introduced another premium offering from our ULED series line, the U800GR. Our first 8K model features 33 million pixels and four times more depth and clarity than a 4K TV. Customers looking to purchase the latest technology will be impressed with its exceptional picture quality that delivers a stunning entertainment experience.

Kawaguchi: Sony’s new Cognitive Processor XR and BRAVIA CORE service are standout features for our customers this year. Due to an increased demand for best-in-class picture quality and content, these two features ensure customers can experience an incredible cinematic experience in the comfort of their homes. Cognitive Processor XR is revolutionary TV processing technology that understands how humans see and hear to deliver intense contrast with pure blacks, high peak brightness, and natural colors. In collaboration with Sony Pictures Entertainment (SPE), BRAVIA CORE is pre-loaded on all new BRAVIA XR models, so users can enjoy a selection of the latest SPE premium and classic titles and the largest IMAX Enhanced movie collection. BRAVIA CORE is the first in the industry to feature Pure Stream technology, achieving near lossless UHD BD equivalent quality with streaming up to 80 Mbps.

Hamdorf: LG OLED will continue to set the standard in picture quality performance. With our new LG OLED Evo panel, introduced in the LG OLEDG1 series in 2021, we will be providing the consumer with the best picture ever in an LG OLED TV. The LG A9 processor is the best-performing processor in the industry and continues to win awards and recognition from expert reviewers. Our newly designed webOS 6.0 user experience will also provide the easiest way to access a virtually endless variety of content in a quick, intuitive manner. We embedded our LG ThinQ AI system, along with the Google Assistant, Amazon Alexa and Apple Airplay2, which allows for voice search, easy control of the TV and content sharing.

Homlish: Skyworth TVs offer the consumer a tremendous value. All of our 4K UHD TVs feature Bluetooth remote controllers with Voice Command operation; the top models have hands-free control capability. Skyworth’s new 2021 OLED TV lineup offerings deliver on the best picture quality experience for the step-up customers seeking performance, and our opening-price-point series of 4K LCD UHD TVs are fully featured TVs with narrow and bezel-less designs, and a wide viewing angle; all of our TVs for 2021 feature the new Android TV best-of-class Smart TV platform.

How have consumer stay-at-home behaviors during the pandemic influenced sales of TVs with particular tech features or performance attributes, beyond their just having ultra-large-screens – for example, TVs suited to gaming, TVs with features geared to viewing of very high-quality content, voice control, AI, etc.? And do you expect these influences to continue as influences beyond the duration of COVID?

Larson: Frankly, I don’t think the pandemic changed any behaviors or desires with our product. However, it has pulled up trends that we have believed in for several years. The shift to streaming, which was becoming obvious pre-pandemic, is now a “must-have,” and by supporting both of the key streaming platforms with our Roku and Google relationships, TCL is well-positioned to delight the consumer with their content availability. As more and more content is consumed on these streaming platforms, the experience that can be delivered with 4K resolution and HDR means that our users are able to enjoy best-in-class performance from TCL televisions.

TCL has been focused on the TV’s role in gaming for many years. Our target demographic enjoys gaming as part of their entertainment experience. This is probably a little different than some of the legacy competitors, where their users are older and less interested in change.

Hamdorf: With the arrival of next-gen gaming consoles, gaming on your TV has become an increasingly important feature to many consumers. There is no better gaming TV than an LG OLEDC1. Ranging in screen size from 48 inches to 83 inches, and with advanced gaming features, the LG OLEDC1 has been covered extensively as the best TV for gaming on the market. LG OLED is still the only TV certified as G-Sync-compatible by NVIDIA, and our new Game Optimizer feature on our 2021 TVs gives the gamer complete control to dial in game settings to maximize their enjoyment and gain a competitive edge. As more and more consumers are cutting the cord, the Smart TV user interface becomes increasingly important. LG’s latest version of webOS is available in our new 2021 TVs, giving consumers access to many of the most popular streaming services as well as emerging services tailored to most every interest.

Kawaguchi: Consumer usage behavior has permanently changed. Since customers are spending more time at home, they are willing to invest more in their at-home entertainment. [There are a] few things customers have shown particular interest in.

[One is] high-quality OLED TVs – in Fiscal Year 2020, the OLED segment grew significantly and outpaced other segments in the market. [Another is] streaming – according to Nielsen, consumers in streaming-capable homes in the U.S. now spend 25 percent of their TV time watching streaming video content, and Sony’s new BRAVIA CORE service with Pure Stream technology achieves near-lossless UHD BD equivalent quality with streaming up to 80 Mbps, [allowing] customers to experience great streamed content without compromising picture quality. [Another is] cinema at home – the home has now become an entertainment hub and people want an amazing cinema-like experience in their living room, which our TVs with Cognitive Processor XR make possible – Cognitive Processor XR is in our 4K, OLED and 8K TVs, meaning consumers can get the best home entertainment experience at a range of price points.

[Then there is] next-gen gaming capabilities – key gaming features like 4K 120fps, Variable Refresh Rate (VRR), Auto Low Latency Mode (ALLM) and e-ARC are highly sought by gamers [and] all these features are included in the BRAVIA XR lineup. [And lastly,] an easy-to-use UI – the XR lineup introduced Google TV, a brand-new entertainment experience that brings together movies, shows, live TV and more from apps and subscriptions. [Consumers can] easily find something to watch with personalized recommendations, and bookmark shows and movies to a single Watchlist to keep track of what to watch [and] users can even add to their Watchlist from their phone or laptop, with Google Search.

Hunt: We find that consumers have streamed more content in 4K/HDR than ever before. The pandemic has driven viewing beyond traditional cable- or satellite-based services where there has been limited 4K/HDR programming or channels. This trend will lead to higher expectations from the consumer for high-quality content and a heightened viewing experience.

Fishler: The pandemic may have accelerated the further development of some of our key features. They are indicative of the growing (years-long) demand for TVs that go beyond an exceptional viewing experience – and they’re here to stay.

AI enables performance never before possible — like within our 8K models that can now offer pristine 8K image quality no matter what the original source resolution is, and audio capabilities that bring the theater experience into the home from the TV itself. Samsung Health and — new for 2021— Smart Trainer offered a comprehensive fitness and wellness platform across TV and mobile at a time when working out at home had become more important than ever before. Smart Trainer leverages an optional USB camera to provide real-time feedback on form, posture and rep counts to further expand on the in-home fitness capabilities.

Simplified Video Chats & Conferencing, including our partnership with Google Duo, make keeping in touch with family and friends, no matter where they are, something that consumers have embraced. And our Remote Access Plus feature enhances productivity and connectivity between personal and professional life from the convenience of the TV screen.

With our Free Samsung TV Plus service, consumers have access to a large library of content at their fingertips, with over 160 channels, all without a subscription. Game Bar, for those passionate about their gaming performance, takes the TV to the next level with capabilities on par with the best gaming monitors. [And] our Multi View capability lets the viewer watch four different sources at once. Imagine being able to experience your game, and follow along with video and even a video conference with your teammates all at the same time….

Gold: The gaming industry has seen a tremendous boom over the last few years but saw record sales in 2020 with the release of the new next-gen consoles. Our 2021 lineup includes added features like Ultra High-Speed HDMI, VRR, ALLM and FreeSync Premium to give consumers the ultimate gaming experience. For consumers adjusting to the work-from-home routine, Far Field voice recognition was integrated into our new lineup so people can easily control their TVs without touching their remote. We also noticed the continued rising trend in larger screen sizes. Especially being at home more than usual over the last year, consumers were looking for bigger screens and more of a home-theater experience. This year, we have 75- and 85-inch options as well as a 120-inch Laser Cinema for an impressive viewing experience.

Ramirez: The two key standouts here are great A/V streaming and quality gaming. For streaming, this means simple operation with fast and easy content discovery and high-quality playback. For gaming, this means faster response times, and even variable refresh rates, to reduce or eliminate input lag. While the demand for these performance attributes was certainly increased by the necessary stay-at-home lifestyle we have all been enduring, such demand existed before COVID, and will only grow as we move forward.

Homlish: The demand for all sizes of TVs was experienced in 2021. Depending on the application, there were smaller sizes that doubled as computer and game monitors; larger sizes are 4K UHD that offer great picture quality, common these days. Important features are robust Wi-Fi connectivity required for video conferencing and cloud gaming. We expect features that support better video and gaming experience with features like VRR (variable refresh rate), ALLC (auto low latency control), and 120Hz. We also see a trend to more affordable high-performance picture quality that plays into our new OLED TV line for 2021. As mentioned earlier, our technology partner for Smart TV is Google, and we are very excited that all of our 4K UHD TVs feature Google Assistant, works with Alexa, and hands-free operation that consumers will grow to enjoy more and more.

What are (or what will be) the operative “feature buzzwords” in the-large-screen TV sector, moving into the second half of 2021?

Hamdorf: The main buzzword is “immersiveness.” It’s all about bringing the movie theater experience, the ultimate gaming experience or the live sports experience into the home in a way that immerses you in it. A big-screen LG OLED delivers that experience with superior picture quality and audio features like Dolby Atmos.

Ramirez: Number One: consistent availability — while not technically a feature, it will remain a key factor. Number Two: big screen — as 55- and 65-inch become mainstream, 75-, 82- and 85-/86-inch become the new aspirational big-screen sizes. Number Three: OLED, QLED, & Mini-LED — and possibly some other new terms that include LED. These are important as they are panel technology innovations that justify a new purchase. Number Four: everything else new (8K, AI, Dynamic HDR, VRR, HDMI 2.1, ATSC 3.0, etc.).

Fishler: We will be hearing a lot about AI in 2021, as consumers experience 8K without the traditional need for native content. In the past, as examples, viewers needed 1080p or 4K content to enjoy the new resolution capabilities. AI has made it possible for consumers to get the improved resolution, without having to purchase a title in the new format. Of course, as the content industry develops content in native 8K, the TVs will be ready to deliver the ultimate viewing experience.

Beyond the picture, we will also see more and more of what we call the Lifestyle TV category. Our new series of outdoor TVs, called The Terrace, have taken the performance of our premium indoor models to the outside of the home, perfect as we enter barbecue season and people can come together again. The Frame continues to appeal to more and more homeowners for whom how the TV blends into their décor is just as important as how the picture looks. The Premiere is the perfect solution for bringing the full cinematic experience home in a way that doesn’t require the “real estate” more traditional projectors needed. These types of TV go far beyond what we are used to in the industry. It’s no longer about “feature sets” from series to series, but rather models that offer consumers the ability to really personalize what they experience from their TV.

Gold: We anticipate a lot of discussion around 8K. With screen sizes getting even larger, it will also be interesting to see how laser TV and short-throw projectors will begin to competitively play in the space and become a more popular alternative to LED TVs.

Homlish: Slim design and bezel-less screens for cosmetics, Dolby Vision and Atmos for picture quality and audio quality performance, and AI control solutions like Google Assistant.

Have display panel pricing increases had an impact as yet at the consumer level? Do you expect them to – and if so, when?

Hunt: Core component costs have increased every month since May 2020 and it has taken till the last few months to show up at the consumer level.

Particularly, you can see this fact with 32-inch Smart TV retail pricing, as this was one of the first sizes that had production constraints. Retail prices for this size have increased almost $30, and there is potential to increase to price points over $200 retail by the end of Q3. TV merchants are carefully managing this trend and are keeping a close eye on their retail peers as they build their business strategies. There is also another aspect that still needs to play out this Fall; component shortages that are affecting all industries will play a role in supply and pricing. With the component shortages, we see resources being focused on larger screen sizes with premium picture technology.

Ramirez: Yes, they have, and changes may continue throughout the summer. The industry could return to stability in the fall, but that is not yet certain.

Larson: We have watched component prices move up at a record pace. Shortages of glass and semiconductors have driven constrained supply availability and pricing on finished goods to increase. We do not expect these moderate price increases to have significant effect on demand as there are still few options to deliver comparable value to an LCD television today. The capabilities and performance of these sets still clearly portray maximum entertainment value. You can get seven to 10 years of joy for your family through the purchase of a 75-inch TV with the same budget you would spend on an overnight stay at a theme park!

Gold: We have already seen an impact on the consumer level and anticipate it will continue.

Homlish: To date, I don’t believe increased panel pricing has had an impact at the consumer level; however, I would expect the impact to occur later in Q3/Q4.

How are you adjusting your marketing supports to aid retailers in accommodating the “new normal” of the sales process, which has moved in the past year more and more to online as opposed to in-store? What are you doing to help dealers more effectively make the case for your TV brand and your technologies in a virtual format?

Ramirez: With the move to more online sales, now and in the future, it is necessary to increase and improve digital assets. This can and will take the form of lifestyle images, 360-degree images, lifestyle videos, product videos, infographics, and much more.

Larson: Due to our demographic, TCL has always been a digital-first company in terms of marketing and presentation. Despite the fact that most TVs are still purchased in a brick-and-mortar store, the research begins online. As a relatively new brand, it is our focus to be in the consideration cycle when that consumer decides they want to purchase a new TV, and that task is best accomplished digitally. At the end of the day, we want the consumer to purchase from the retailer they feel most comfortable with, but our role is to ensure that the choice is to consider a TCL television from that retailer.

Homlish: 2020 was a year of realization that video telecommunications can address many business challenges we faced during the stay-at-home / work-at-home realities. Meetings with our customers, virtual sales training, and consumer product support videos that can be downloaded or streamed online. We are investing in offering pre- and post-sales support tools via our new website that will support and service the consumer, our business partners, and elevate the Skyworth brand in the North American marketplace.

Hunt: In 2020, retailers needed to focus on their online engagement with consumers. Either pick-up-at-store or online fulfillment have been perfected out of necessity, due to state restrictions. We have worked hard to create enhanced content, manage consumer reviews and build our brand online with all of our partners. Though the economy is now opening back up, our focus will continue to grow our brand online with our retail partners.

Fishler: In 2021, we’ve invested heavily in product and brand assets that are available to all of our retail partners, which will allow for improved digital engagement with consumers on their sites, as well as omni solutions that better connect online and offline retail experiences in store and across their digital properties.

Thinking far down the retail road, what points of focus will you concentrate on in striving to communicate your TV lines’ technologies and advantages to consumers after the COVID situation resolves?

Ramirez: We need to evolve as the world evolves. The future will necessitate a mix of old-school message reinforcement for those at the last three feet, a more personal approach to digital messaging for the consumer, leveraging social media and peer-to-peer evangelism, and being creative to develop new, fun ways to gain exposure while adding value.

Fishler: During the pandemic, Samsung developed a contactless interactive option for consumers that preferred not to touch displays at retail. The consumer would scan a QR code that enabled them to select content choices using their personal device and interact with the display. The functionality was the same as if they touched the interactive buttons on the display. [It was] an innovative solution that addressed the needs of the time.

As we look ahead, our new digital/ecommerce world is here to stay. We will continue to innovate further to drive even more consumer-centric engagement and interactivity with our products online, and to provide omnichannel exploration, shopping, purchase, and delivery solutions for more seamless, convenient and delightful consumer experiences with our brand.

Homlish: Skyworth will be investing more on digital marketing in further developing the brand in this important marketplace, and simultaneously investing resources in developing and reaching the customers of our retail and online distribution partners. The behavioral paradigm that evolved through the last year was more dependent on online resources, and we see this playing a larger part in a consumer’s purchase journey.

What do you think will be the biggest challenge affecting major TV vendors such as yourself – and what will be the biggest opportunity – in the post-pandemic period, assuming that that period will be in 2022?

Hamdorf: Supply continues to be a major issue in 2021. But with that challenge is a great opportunity for LG. One hundred percent of the OLED panels in LG TVs come from LGD. The partnership with LGD has created a much more reliable supply of LG OLED TVs in the market vs. competitive-brand LED TVs. We are confident that we can supply LG OLED TVs in 2021 to meet the rapidly growing demand.

Hunt: Clearly, everybody is focused on how the higher prices in the market will affect sell-through. The market is being reset for the first time in more than a decade, so it is a bit of new ground. Consumer prices are rising for goods and services at a rate that we have not seen since 2008. We have to be very focused on supporting our retail partners until there is more stability.